New Endowment Plan

Is a non-linked, participant-based plan that offers both security and savings. This combination offers financial support to the family of the deceased insurance holder during the policy’s term. This plan is ideal for those who want to save regularly while also having life insurance.

Premium

LIC New Endowment Plan- 914, offered by LIC of India, is a participating endowment plan that offers the dual benefit of protection cum saving plan. LIC New endowment plan comes with both death and maturity benefits.

Have any Questions?

Call us Today!

Bonuses

The combination of saving cum protection provides a financial cushion to the family of the deceased insurance holder during the tenure of the policy. Moreover, if the insurance buyer survives the entire tenure of the policy, then they receive the lump-sum amount as a maturity benefit at the time of policy maturity. Moreover, by providing a loan facility, LIC New Endowment Plan also manages the liquidity needs.

Benefits in case of death during the selected term

The Sum Assured along with the vested bonuses is payable on death in a lump sum.

Benefits in case of survival to the end of selected term

Earlier, LIC Endowment Plan 814 was offered by the company, which is now withdrawn and is no longer available for sale. Hence, individuals who want to secure their loved ones, can purchase LIC New Endowment Plan 914.

Accident Benefit

An additional Sum Assured (subject to a limit of Rs.5 lakh) is payable in a lump sum on death due to accident up to age 70 of life assured. In case of permanent disability of the life assured due to accident this additional Sum assured is payable in instalments. Supplementary/Extra Benefits : These are the optional benefits that can be added to your basic plan for extra protection/option. An additional premium is required to be paid for these benefits.

Surrender Value

Surrender Value means an amount, if any, that becomes payable in case of surrender in accordance with the terms and conditions of the policy.

Guaranteed Surrender Value

Guaranteed Surrender Value is the minimum guaranteed amount of Surrender Value payable to the policyholder on surrender of the policy.

Corporation’s policy on surrenders

In practice, the Corporation will pay a Special Surrender Value – which is either equal to or more than the Guaranteed Surrender Value. The benefit payable on surrender reflects the discounted value of the reduced claim amount that would be payable on death or at maturity. This value will depend on the duration for which premiums have been paid and the policy duration at the date of surrender. In some circumstances, in case of early termination of the policy, the surrender value payable may be less than the total premium paid. The Corporation’s surrender value will be reviewed from time to time and may change depending on the economic environment, our experience and other factors.

Note

The above is the product summary giving the key features of the plan. This is for illustrative purpose only. This does not represent a contract and for details please refer to your policy document.

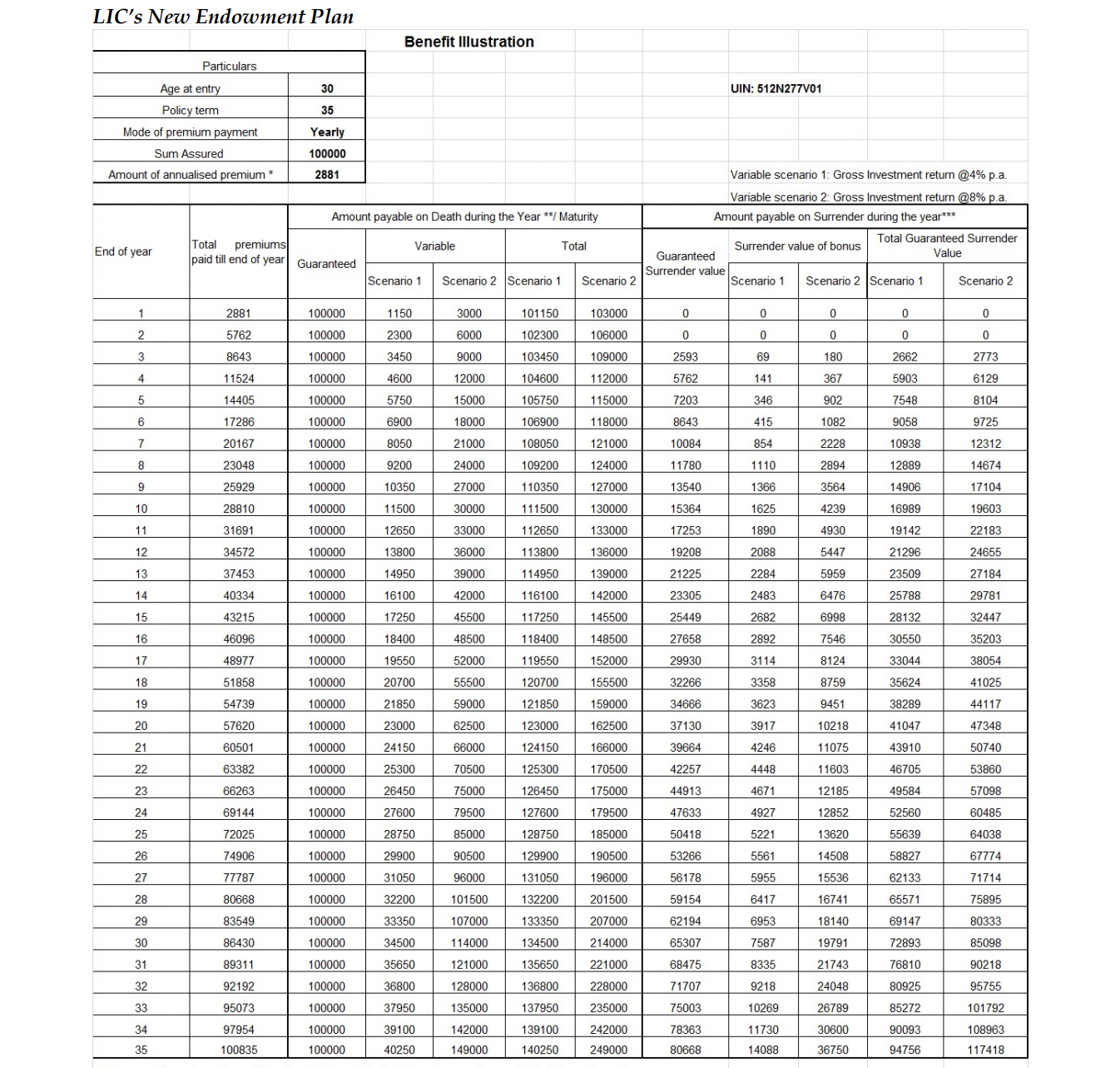

Benefit Illustration

Statutory warning “Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your insurer carrying on life insurance business. If your policy offers guaranteed returns then these will be clearly marked “guaranteed” in the illustration table on this page.”

Death Benefit

Death benefit payable in case of death of the Life Assured before the stipulated Date of Maturity provided the policy is in-force shall be “Sum Assured on Death” along with vested Simple Reversionary Bonuses and Final Additional Bonus, if any. Where, “Sum Assured on Death” is defined as higher of Basic Sum Assured or 7 times of Annualized Premium. This death benefit shall not be less than 105% of total premiums paid(excluding any extra premium, any rider premium and taxes) upto the date of death. The Death Benefit shall be paid in lumpsum as specified above and/or in instalments, as specified in Condition 8 of Part D of this Policy Document, as per the option exercised by the Policyholder/Life Assured.