Jeevan Anand

The plan is specifically designed to have an adequate corpus to meet the higher education and other needs of your child. It facilitates accumulation of corpus through Guaranteed Addition.

Premium

An individual can pay the LIC premium on a yearly, half-yearly, quarterly or monthly basis as per the convenience. Moreover, the insured could also look for loans from this plan. The grace period or payments delayed could differ from the premium payment frequency.

Have any Questions?

Call us Today!

ELIGIBLE

- i. Minimum Age at entry 0 years (30 days completed)

- ii. Maximum Age at entry 13 years (last birthday)

- iii. Minimum Age at maturity 18 years (last birthday)

- iv. Maximum Age at maturity 25 years (last birthday)

- v. Minimum Policy Term Limited Premium Payment: 10years Single Premium Payment: 5years

- vi. Maximum Policy Term Limited Premium Payment: 25 years Single Premium Payment: 25 years In case of policies procured through POSP-LI/CPSC-SPV: 20 years

- vii. Premium Payment Term Limited Premium Payment: 5, 6 & 7 years

Guaranteed Additions for In-force policy

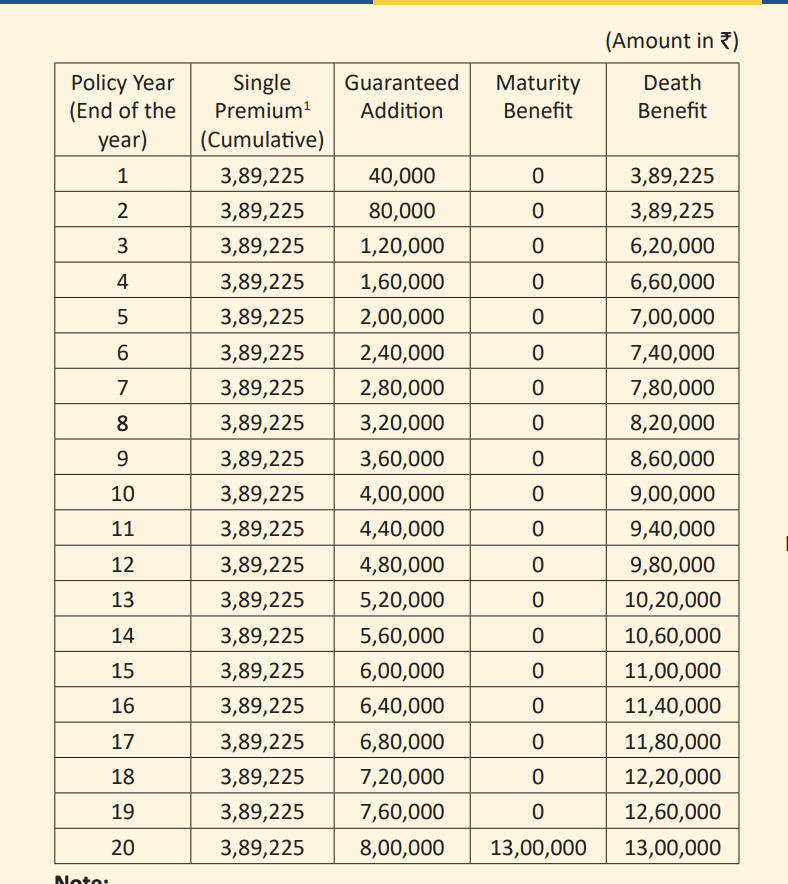

Under an in-force policy, the Guaranteed Additions shall accrue at the rate of ` 80 per thousand Basic Sum Assured at the end of each policy year from the inception till the end of Policy Term. On death of Life Assured during the Policy Term under an in-force policy, the Guaranteed Additions in the year of death shall be payable for full policy year. In case of surrender of an in-force policy, the Guaranteed Additions for the policy year in which the policy is surrendered will be added on proportionate basis in proportion to the completed months for the Policy Year in which policy is surrendered.

Key Features

- Guaranteed Addition ` 80 per thousand Basic Sum Assured throughout the Policy Term.

- Option to choose Life Insurance coverage for your child as per the needs.

- Flexibility to o Choose from Single Premium and Limited Premium Payment. o Choose the maturity age from 18 to 25 years for the various needs of your child o Opt for payment of benefit in instalments.

- Option to choose Premium Waiver Benefit rider on payment of additional premium.

- Benefit of attractive High Sum Assured Rebate.

- Takes care of liquidity needs through loan facility.

Maturity Benefit

On Life Assured surviving the stipulated Date of Maturity, provided the policy is in-force,“Sum Assured on Maturity” along with accrued Guaranteed Additions for in-force policy, shall be payable; where “Sum Assured on Maturity” is equal the Basic Sum Assured.

TAXES

Statutory Taxes, if any, imposed on such insurance plans by the Government of India or any other constitutional Tax Authority of India shall be as per the Tax laws and the rate of tax as applicable from time to time. The amount of applicable taxes, as per the prevailing rates, shall be payable by the policyholder on premium(s) (for Base Policy and Rider, if any) including extra premiums, if any, which shall be collected separately over and above in addition to the premium(s) payable by the policyholder. The amount of tax paid shall no.